Are you considering outsourcing your accounts payable? Did you know that businesses can cut accounts payable costs by up to 70% through outsourcing?

Leveraging accounts payable outsourcing services offers a strategic opportunity to streamline financial processes, boost accuracy, and ensure compliance. However, outsourcing can come with challenges, such as potential communication gaps or reduced control over processes.

This article will explore the benefits that accounts payable outsourcing can bring to your organization, helping you make informed decisions that support your growth and operational goals.

GET A FREE QUOTE: For a deeper dive into our services and how we can tailor them to your unique needs, explore our accounts payable staffing and outsourcing services.

What is Accounts Payable Outsourcing?

Accounts payable outsourcing is the practice of delegating the management of AP functions to specialized external providers. These companies leverage advanced technology and industry expertise to streamline invoice processing, payment execution, and compliance management.

According to Grand View Research, the global accounts payable outsourcing market is projected to reach $5.4 billion by 2027, growing at a CAGR of 9.4%. This growth is driven by businesses recognizing the value of outsourcing non-core functions to focus on their primary objectives.

Accounts Payable Process

The accounts payable process consists of several key steps to ensure timely and accurate payments to vendors.

- Invoice Receipt: Vendors send invoices for goods or services. Invoices can arrive by email, mail, or vendor portals. Automation can help reduce errors.

- Invoice Verification: Each invoice is checked against purchase orders and receiving reports. This ensures accuracy and prevents overpayments.

- Approval Workflow: Invoices need approval from designated personnel. Outsourcing can speed up this process by using predefined workflows.

- Data Entry and Coding: Approved invoices are entered into the accounting system and assigned account codes. Automation can make this faster and more accurate.

- Payment Processing: Payments are scheduled based on vendor terms and cash flow needs. Using automation helps manage early payment discounts effectively.

- Record Keeping: All documents, like invoices and payment confirmations, are stored for audits. Digital storage solutions make this easy and accessible.

- Reconciliation: Accounts payable records are periodically compared to vendor statements and general ledger accounts. This ensures accuracy and prepares for audits.

- Reporting and Analysis: Reports on accounts payable activities, like payment trends, are generated. Outsourced AP services often provide analytics tools for better insights.

Read more: Outsourced Bookkeeping Services: What It Is & Why Use It

Benefits of Outsourcing Accounts Payable

One of the key pros of outsourcing accounts payable services is that it enables businesses to improve efficiency and reduce operational costs, allowing them to focus on their core competencies.

Cost Reduction

Outsourcing accounts payable functions can significantly cut down on costs associated with hiring and training staff, maintaining an in-house AP department, and investing in the necessary technology and infrastructure.

For example, the average salary for an in-house AP clerk in the United States averages around $45,366 annually, not including benefits and taxes. Outsourcing lowers these costs by providing access to a team of experts at a fraction of the price.

In-house operations often require substantial investment in technology and infrastructure. A robust AP software suite alone can cost upwards of $10,000, coupled with maintenance and upgrade fees. By transitioning to an outsourced model, businesses can expect to see a reduction in overall AP costs by as much as 70%, a figure drawn from our extensive experience and market analysis in the field.

Read more: Effective Ways to Reduce Labor Costs

Enhance Efficiency and Productivity

Companies who outsource accounts payable services introduce a new level of efficiency and productivity to their team, thanks to the advanced technologies and automated processes of specialized firms.

For instance, while manual invoice processing typically takes 10-15 days, automation can reduce this to just 3-5 days, boosting productivity significantly. Moreover, the precision of automated systems reduces the error rates from around 1-3% in manual handling to near-zero, ensuring financial accuracy and compliance.

Focus on Core Business Activities

Outsourcing accounts payable tasks allows businesses to realign their focus towards the heart of their operations – key areas like product development, customer service, and strategic planning. By shifting the responsibility of accounts payable operations to specialized providers, companies can dedicate more time and resources to these core activities, driving growth and innovation.

This strategic reallocation of efforts not only enhances overall business efficiency but also fosters a more dynamic and competitive organizational environment.

Access to Expertise

Outsourcing firms specialize in AP management, ensuring not only efficiency but also strict compliance with evolving regulatory standards. These providers stay at the forefront of industry best practices, offering insights and strategies that might be beyond the scope of an in-house team.

This level of expertise ensures that AP processes are handled with the utmost professionalism and up-to-date knowledge, safeguarding businesses against compliance risks and inefficiencies.

Scalability

Outsourcing accounts payable offers unparalleled scalability, allowing businesses to adjust their AP operations in alignment with their growth trajectory and seasonal demands. This flexibility negates the need for internal staffing adjustments, which can be both time-consuming and costly.

Whether scaling up to accommodate a surge in invoices during peak seasons or scaling down in slower periods, outsourcing ensures that the AP function seamlessly adapts to the business’s evolving needs, providing a dynamic solution that aligns with the company’s current and future states.

Improve Cash Flow Management

Efficiently managed accounts payable processes through outsourcing significantly enhance a business’s ability to control and optimize cash flow. This efficiency enables companies to capitalize on early payment discounts and avoid costly late payment penalties.

By having a streamlined and predictable AP process, businesses can plan and allocate their financial resources more effectively, ensuring a healthier cash flow management system that supports financial stability and strategic investments.

Drawbacks of an Accounts Payable Outsourcing Service

The cons of outsourcing accounts payable services include potential risks related to data security and a possible loss of control over critical financial processes.

Read more: 7 Outsourcing Myths Holding Back Your Business Growth

Risk of Losing Control

One of the most significant drawbacks of AP outsourcing is the reduced control over your financial processes. When you delegate AP tasks to an external provider, you’re no longer overseeing the daily operations directly. This can make it difficult to track progress, resolve issues quickly, or ensure that the provider is meeting your company’s accounts payable needs.

To maintain better oversight, establish clear communication channels and regular reporting protocols with your outsourcing partner. Request real-time dashboards or reports that provide transparency into the AP process.

Data Security and Privacy Concerns

Employing an outsourced AP team means sharing sensitive financial data with a third party, which introduces the risk of data breaches or unauthorized access to confidential information. Even with the best data protection measures in place, there is always some degree of risk in handing over critical financial data.

Choose an outsourcing provider with robust security measures, including encryption, secure data storage, and compliance with data protection laws.

Dependency on the Service Provider

Relying heavily on an external service provider for essential financial tasks can be risky. If the provider experiences technical issues, service disruptions, or even goes out of business, your AP function could come to a halt, causing delays in vendor payments and impacting cash flow.

To mitigate this risk, have clear contracts with service-level guarantees that specify performance metrics, uptime, and data recovery protocols.

Potential Communication Barriers

Working with an external AP service provider, especially one in a different time zone or country, can create communication barriers. Delays in responses or misunderstandings due to language or cultural differences may lead to errors in processing or disrupt the workflow.

To address potential communication issues, ensure that the provider offers multiple ways to communicate, such as phone, email, and chat support.

Customization Limitations

While many outsourcing firms offer scalable solutions, not all of them can tailor their services to fit your unique business needs. Rigid processes that aren’t customized can result in inefficiencies or missed opportunities for optimizing your AP operations.

Before selecting a provider, assess whether they can offer customizable services that align with your specific AP workflow. Ask how adaptable they are to changes in volume, processes, or technology, and request case studies or examples where they’ve customized solutions for other clients.

Should Your Business Outsource AP?

When considering whether to outsource accounts payable (AP), it’s essential to assess your current processes for efficiency and cost-effectiveness. If your in-house AP functions are cumbersome or expensive, outsourcing may provide a streamlined solution that can save both time and money.

Evaluate your business’s growth and scalability needs, as outsourcing offers the flexibility to adapt to rapid growth without significant internal changes. Additionally, if managing AP tasks distract your team from core business goals, outsourcing can free up resources to focus on strategic initiatives that drive your objectives forward.

Read more: 10 Common Accounting & Finance Functions You Can Outsource

REMEMBER: Outsourcing AP should be considered if it aligns with your business’s financial strategy, operational efficiency goals, and long-term growth plans.

Accounts Payable Outsourcing vs Accounts Payable Automation

AP automation focuses on improving the efficiency and accuracy of accounts payable tasks through the use of technology. This approach leverages accounts payable software solutions to streamline processes such as invoice capture, approval workflows, and payment processing, allowing businesses to manage these functions internally.

Unlike AP outsourcing, which involves handing over all AP responsibilities to a third-party provider, AP automation keeps the management of the accounts payable processes within the organization. With automation, companies maintain control over their AP operations while benefiting from faster processing times and reduced manual errors.

Outsourcing is often favored by businesses looking for a hands-off approach and access to external expertise, while automation is preferred by those wishing to maintain control in-house with improved efficiency.

AP Outsourcing vs. Accounts Receivable Outsourcing

AP outsourcing involves delegating tasks like invoice processing and vendor management to an external provider, leading to cost savings, improved accuracy, and better compliance. On the other hand, outsourcing accounts receivable services involve invoicing and collections, resulting in faster payments and improved cash flow.

Read more: Top 10 Reasons To Outsource Accounts Receivable (AR)

What to Look For in Accounts Payable Outsourcing Companies

Selecting the right accounts payable (AP) service provider is a critical decision for any business looking to outsource this key function. The right partner can transform your AP processes, enhancing efficiency, accuracy, and financial health.

Evaluate Their Expertise and Track Record

The provider’s experience in handling accounts payable is paramount. Look for a firm with a proven track record of managing AP tasks effectively. Check their client portfolio and seek testimonials or case studies. Providers with experience in your industry or similar business sizes can offer tailored solutions that better fit your needs.

Assess Technological Capabilities

The technology used by the AP service provider is important. They should offer advanced solutions like automation, electronic invoicing, and cloud-based systems. These technologies streamline the AP process and provide greater visibility and control. Inquire about their data security measures and compliance with regulations.

Consider Customization and Scalability

Every business has unique needs, and your AP service provider should be able to tailor their services accordingly. Whether it’s handling different types of invoices, integrating with your existing financial systems, or scaling services in line with your business growth, the provider should be flexible and adaptive.

Check for Comprehensive Service Offerings

A good AP service provider should offer a comprehensive range of services. This can include invoice processing, payment execution, tax and regulatory compliance, and even strategic financial planning and analysis. Having a full suite of services ensures that all your AP needs are covered under one roof, simplifying management and communication.

Analyze Cost vs. Value

While cost is an important factor, it should not be the only consideration. Assess the value the provider brings to your business. This includes the direct costs saved and the indirect benefits like increased efficiency, reduced errors, and better cash flow management. A provider offering services at a very low cost might not always deliver the quality or breadth of services needed.

Prioritize Communication and Support

Effective communication and customer support are crucial for a smooth partnership. The provider should have clear communication channels and be responsive to your queries and concerns. Regular reporting and meetings to discuss performance and improvements should be part of their service.

Review Their Compliance and Industry Standards Adherence

Ensure that the provider adheres to the relevant industry standards and regulatory requirements. This is particularly important for financial services and businesses operating in highly regulated sectors.

Accounts Payable Outsourcing Services

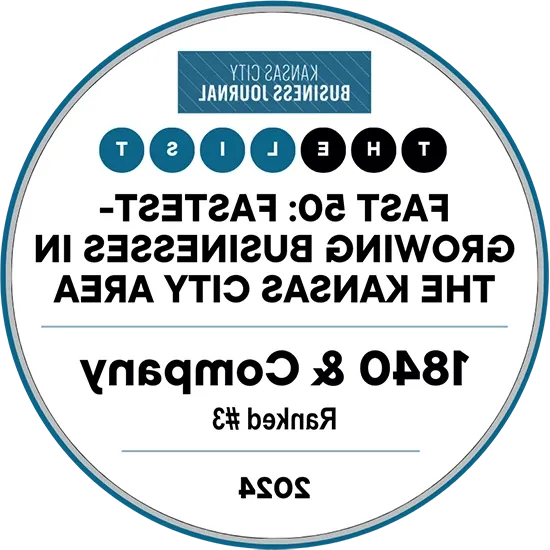

At 1840 & Company, we provide comprehensive accounts payable (AP) outsourcing services that help streamline your financial operations and improve overall efficiency. Our team handles the entire AP process from start to finish – from receiving invoices to disbursing payments – ensuring that your payments are processed accurately and on time, helping you avoid costly late fees.

With our global team of experts, we can manage both local and international AP processes, making sure you’re always in compliance with the latest tax regulations. Outsourcing your accounts payable to us not only saves you the hassle of maintaining an in-house accounts payable department but also reduces costs associated with staffing and technology investments. Plus, our solutions are scalable, so whether you’re a startup looking to outsource or a large enterprise needing extra hands, we can adapt to your needs.

Finding The Right AP Outsourced Solution For Your Business

By selecting the right partner, leveraging technology effectively, and managing the outsourced relationship strategically, businesses can transform their accounts payable function into a source of competitive advantage.

To explore how our AP outsourcing and staffing solutions can benefit your organization, schedule a call and let us tailor a strategy that aligns with your unique business needs.